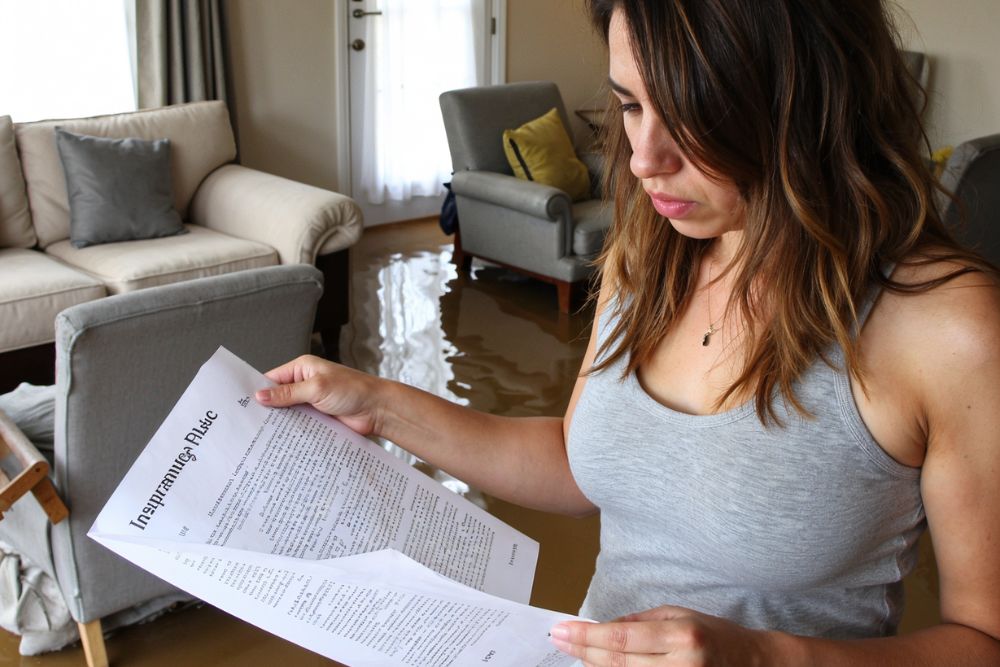

When water damage strikes, the aftermath can feel overwhelming. Many homeowners in Auckland often wonder whether their home insurance covers cleaning and restoration after water damage. This article delves into the specifics of what is typically covered, potential exclusions, and what homeowners should be aware of when assessing their insurance policies. Understanding the details can make a significant difference in how effectively you manage water damage and restore your home.

What Types of Water Damage Does Home Insurance Typically Cover?

Home insurance policies in New Zealand generally provide coverage for unexpected and accidental water damage. This usually includes damage caused by specific incidents like burst pipes or overflowing appliances. For instance, if a washing machine hose bursts and floods your laundry room, this type of event is considered accidental and sudden, making it eligible for insurance coverage.

Another common covered scenario is water ingress due to a severe weather event. Heavy rainfall or storms can lead to roof leaks or water seeping into your home, causing structural damage or water-logged interiors. In such instances, home insurance policies will often cover the restoration and cleaning required to return your home to its original condition, provided the damage was unforeseen.

However, it is essential to read the fine print of your policy. Different insurers may have different guidelines regarding what incidents qualify for coverage. Consulting with your insurer and reviewing your specific policy are crucial steps to avoid any surprises during a claim.

Burst Pipes and Plumbing Failures

Burst pipes are one of the most frequent causes of water damage in households. Most home insurance policies cover the resulting water damage and restoration services required to address this issue. The cover typically includes repairs to damaged walls, floors, and furnishings caused by the leaking water.

However, keep in mind that the root cause of the problem (e.g., repairing the actual burst pipe) may not always be covered. For instance, insurers generally do not provide payments for fixing ageing plumbing systems but will often cover the resulting water damage if the burst happened suddenly and wasn’t due to negligence or poor maintenance.

Storm and Flood Damage

Heavy rainstorms are not uncommon in Auckland, and they can lead to substantial water damage to homes. Roof leaks, flooded basements, and damaged walls caused by stormwater are often covered by home insurance policies. Storm-related water damage typically falls under the “weather event” clause of most policies.

That said, flooding caused by rising rivers or tidal water might not be covered under standard home insurance policies. Instead, you may need to purchase separate flood insurance as an add-on to your existing policy. Make sure you have a clear understanding of what type of flooding is included in your cover, particularly if your home is near a flood-prone area.

When Does Home Insurance Not Cover Water Damage?

Just as there are events that are covered, there are also situations where insurance companies will deny claims for water damage. Knowing what isn’t covered can help you take preventive measures to avoid unnecessary costs.

Gradual Damage and Negligence

In most cases, gradual damage caused by neglect or deferred maintenance is not covered. For example, if your roof has been leaking over several years and causes water damage to your ceiling, insurers may refuse to pay for the restoration because the damage could have been prevented with regular maintenance.

Similarly, if your plumbing system develops a slow leak over time and results in water damage, this will likely not fall under your insurance coverage. Insurers typically categorise such issues as wear and tear, which are not considered accidental or unexpected, and hence are excluded from coverage.

Water Damage from Earthquakes

Earthquakes, though infrequent, can lead to significant home damages, including water damage from broken pipes or ruptured plumbing systems. In New Zealand, earthquake-related damages are usually covered by the Earthquake Commission (EQC) rather than your home insurance provider. If water damage occurs due to an earthquake, you’ll need to file a claim with the EQC for financial assistance.

Uninsured Flooding Events

If your policy doesn’t include specific flood coverage and a flooding event occurs in your area, you may find yourself ineligible for insurance-backed support. For this reason, it’s crucial for homeowners, especially those living in flood-risk areas, to opt for additional flood insurance if it’s not already a part of their standard policy.

How to File an Insurance Claim for Water Damage in Auckland

Filing an insurance claim for water damage requires thorough documentation and prompt action. Begin by capturing photographs of the damage and ensuring you notify your insurer immediately. Provide them with detailed information about the incident, including the suspected cause of the water damage.

Most insurance policies also mandate swift steps to mitigate further damage. For instance, if your home is flooding due to a burst pipe, you’ll need to shut off the water supply to prevent additional damages. Be sure to keep receipts for any emergency repairs to claim as part of your reimbursement.

The Role of Professional Water Restoration Services

Engaging a professional water restoration and cleaning service like RestorePro in Auckland can significantly simplify your insurance claim process. Insurers often prefer certified restoration experts who can provide comprehensive assessments and detailed reports about the extent of the damage. This kind of professional documentation can strengthen your claim and streamline the approval process.

Why Timely Restoration Matters

Delaying water damage restoration can lead to severe secondary consequences, including mould growth and structural weakening of your property. Even if you’re in the process of filing an insurance claim, it’s essential to act quickly to address water damage. Many insurers require homeowners to take “reasonable steps” to mitigate further damage while the claim is being processed.

Professional water restoration services like RestorePro not only offer quick response times but also deliver expert cleaning and full restoration to ensure your home is fully habitable as soon as possible.

How to Prevent Water Damage

While insurance is there to provide financial relief in case of unexpected events, prevention is always better than cure. Regular home maintenance can significantly cut down your risk of water damage.

Maintain Your Roof and Gutters

Blocked gutters can cause water to pool and flow into areas it shouldn’t, leading to water damage. By cleaning your gutters regularly and fixing loose roof tiles, you can prevent rainwater from creating havoc during storms.

Inspect Your Plumbing

Scheduling routine plumbing inspections ensures minor leaks and ageing components are addressed before they become major issues. Don’t forget to keep an eye out for signs of water stains on walls and ceilings, as these could indicate hidden leaks.

Install Water Leak Detectors

Modern technology, like water leak detectors, can alert you to potential leaks before they cause significant damage. These devices are especially useful in areas like Auckland, where appliances and heavy rainfall can present a risk of unexpected water damage.

Need Assistance With Water Damage Restoration in Auckland?

Dealing with water damage can be a daunting experience, but professional help is just a phone call away. At RestorePro, we specialise in comprehensive water damage cleaning and restoration services in Auckland. Our experienced team works seamlessly with insurance providers to ensure your claim is processed efficiently while restoring your home to its pre-damage condition.

If you’re facing water damage and need expert assistance, contact RestorePro today at 0800 843 776. Don’t let water damage disrupt your life—let us help you get back on track quickly and efficiently.